You deserve a real estate agent that gets you the upper hand

Hey, I’m Darin, your Surrey REALTOR, and we can help.

We understand selling a home to buy a new one can feel incredibly overwhelming and stressful; it’s a massive event in your life and there is a lot of pressure to get it right. At the Germyn Group, we get it and take your challenges very seriously.

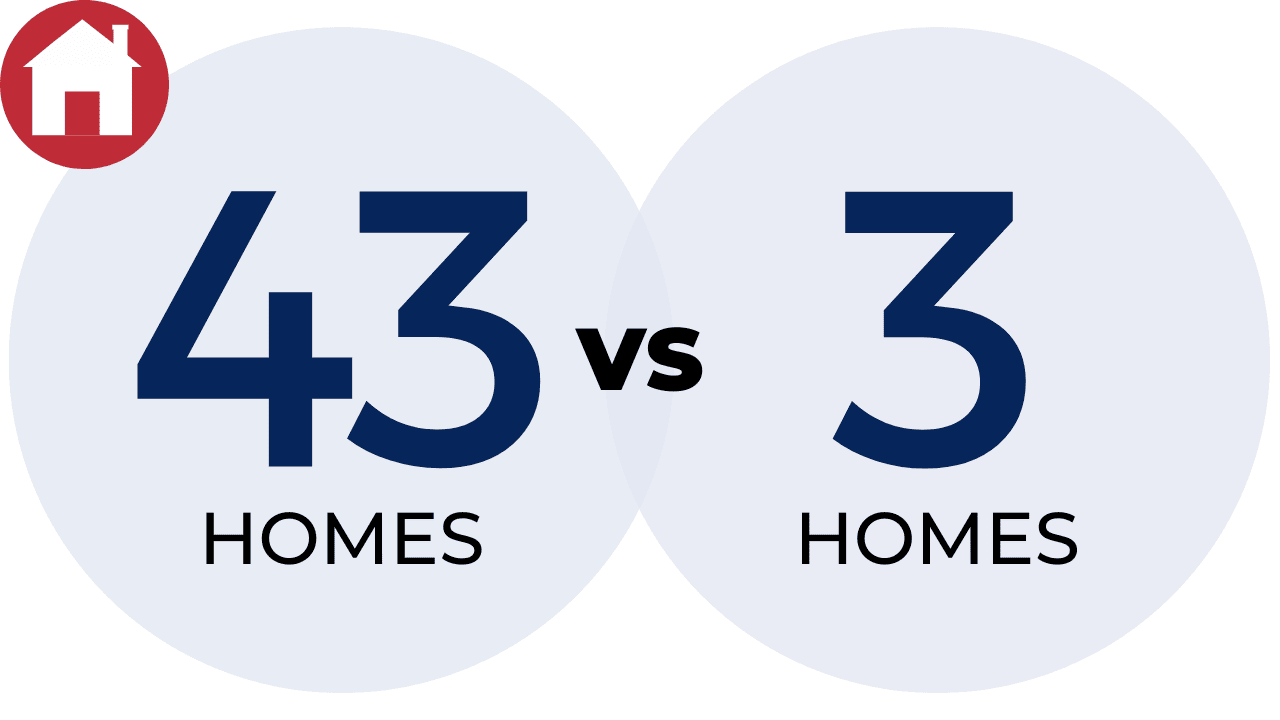

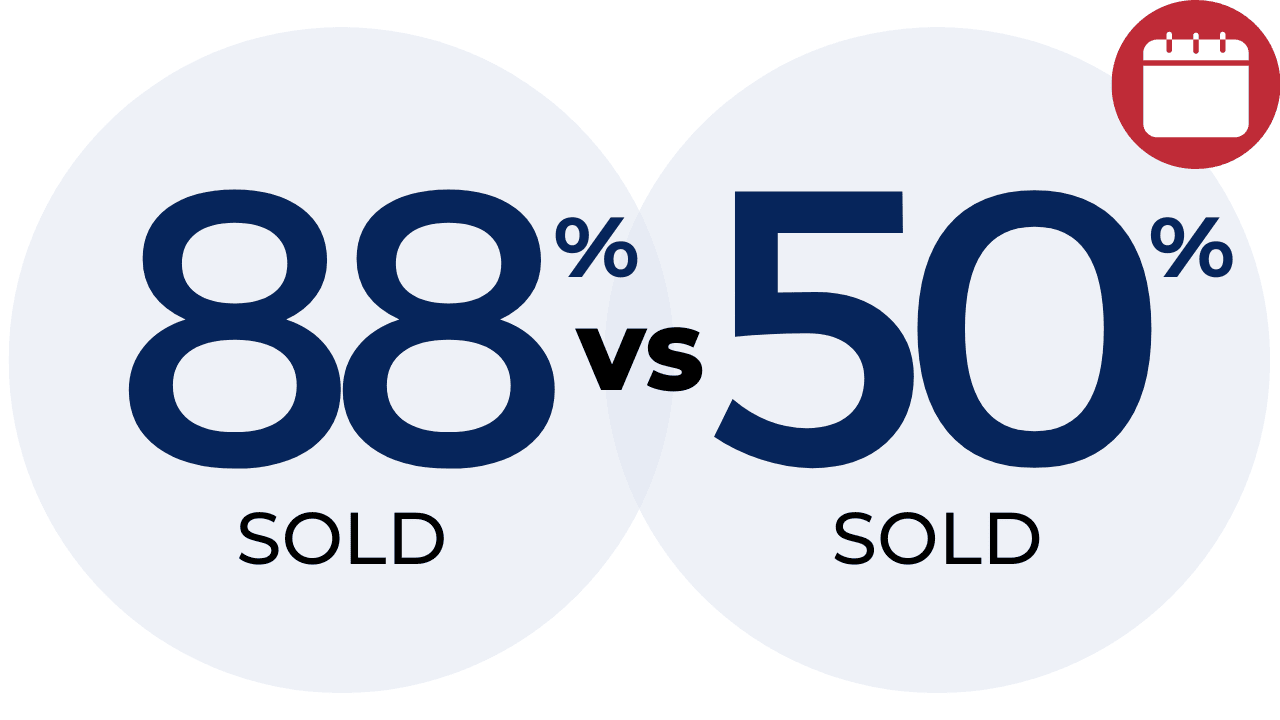

That’s why we have taken the unknowns our of the entire process with a strategy that helps you maximize the sale price of your home, minimize the inconvenience of selling, and helps you make a deal on the perfect new place to call home at a price that will make you smile.

You don’t have to feel confused or intimidated by the process. Working together with the team at the Germyn Group you can expect industry-leading guidance, home preparation, marketing, negotiation and results. You might even have a little fun along the way too (no additional charge).

2019 President Fraser

Valley Real Estate Board

Top 1% in FVREB

by volume

600+

families helped

DO NOT sell your home until you've read this...

Warning: selling your home before reading this e-book will set you up to fail.

Just Don't Sell is a free resource for:

- An effective marketing strategy for achieving the best price for your current home;

- Making a smooth sale;

- and successfully transitioning into a bigger home.

Download your copy now and take the risk out of selling your home.

"(Required)" indicates required fields