Explaining the New Construction Tax Exemption in BC

Buying a new home is always an exciting journey, but it can also be a financial roller coaster. Fortunately, if you’re in British Columbia, there’s some good news on the horizon.

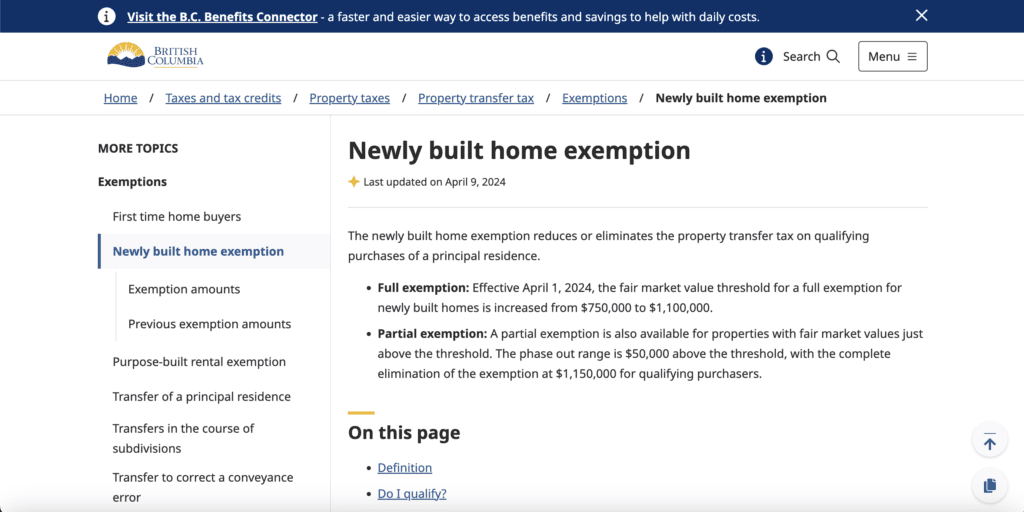

The new construction tax exemption is undergoing significant changes effective April 1, 2024, which could save you a considerable amount of money. Let’s dive into the details of this exemption, its history, and what it means for you as a potential homebuyer.

Explaining the new construction tax exemption in BC ???? Newly Built Home Buyer’s Rejoice!

My name is Darin, the team leader with the Germyn Group, with Macdonald Realty, a REALTOR in Surrey, British Columbia.

If this is your first time reading our blogs, we are here to educate you on everything there is to know about living in Surrey or White Rock, British Columbia. If you’re looking to make a move in the next 9 days, 90 days or 9 months, shoot us a text, give us a call, or book an in-person zoom meeting with us so we can learn a little bit more about your situation and let you know what we can do to help you. This way, we can make sure your move to Surrey or White Rock is a smooth one

What is the New Construction Tax Exemption?

Starting from April 1, 2024, BC’s new construction tax exemption will remove the Property Transfer Tax for qualifying home buyers on newly built homes. Previously, this full exemption was available only for homes valued under $750,000. However, the new qualifying amount has been increased to $1,100,000. This is a substantial increase and can lead to significant savings for homebuyers.

Who qualifies for the Exemption?

Photo courtesy of chillla70 on Pixabay

To benefit from this exemption, the property must be located in British Columbia, and the buyer must be either a Canadian citizen or a Permanent Resident of Canada.

Additionally, the home must be your principal residence. This means it cannot be used as a rental or investment property. For more detailed qualification criteria, you can refer to the BC government’s website here.

How Much Can You Save?

Photo courtesy of nosheep on Pixabay

With the new threshold raised to $1,100,000, qualifying home buyers can save up to $20,000 on the Property Transfer Tax when purchasing new construction.

This is an increase from the previous maximum savings of $13,000. Essentially, this adjustment allows more buyers to benefit from the exemption, especially in the current market where finding new construction under $750,000 is increasingly rare.

A Brief History of the Exemption

The newly built home exemption in BC was introduced in 2016 to combat rising home prices and improve housing affordability. Initially, it provided a full Property Transfer Tax exemption for newly built homes valued up to $750,000, with a sliding scale up to $800,000.

This was particularly beneficial for buyers of condominiums and townhomes, which often fell within this price range. The exemption made it easier for first-time homebuyers and those looking to upgrade to newer properties.

However, with continued increases in housing prices, the previous threshold became less effective. To address this, the BC government has raised the exemption threshold to $1,100,000, starting April 1, 2024. This adjustment aims to extend the benefits of the exemption to more homebuyers in today’s market.

What’s the Catch?

While the new exemption is great news, there’s another tax to be aware of: the big bad GST!. Even with the Property Transfer Tax exemption, homebuyers are still required to pay 5% GST on ALL new construction properties.

For example, a home valued at $1,100,000 will incur a 5% GST of approximately $55,000. It’s crucial to factor this into your budget when planning your purchase.

The GST can significantly impact your overall costs, and many buyers often overlook this additional expense. Understanding the full financial implications is essential to avoid any surprises during the buying process. Proper financial planning will ensure you are fully prepared for all costs associated with purchasing a new home.

See what this means if you’re buying in Surrey.

Conclusion

The changes to the new construction tax exemption in BC are a welcome relief for many homebuyers. By increasing the qualifying amount to $1,100,000, the BC government is making it easier for more people to enter the housing market and save on Property Transfer Tax.

However, remember to consider the GST in your financial planning.

What if I have any questions about moving to Surrey or White Rock, BC?

Selecting an excellent real estate professional is key to a successful home purchase. The Germyn Group, with our deep understanding of White Rock and its real estate dynamics, is committed to guiding you every step of the way.

We invite you to book a consultation with us. During our meeting, we’ll discuss your needs, preferences, and any questions you might have about the Surrey real estate market.

As you embark on this exciting journey, remember that the right home in Surrey is more than just a property; it’s a foundation for your future. With the Germyn Group by your side, let’s make your dream of homeownership in Surrey a beautiful reality.

People lose money in real estate because they don't know what's actually happening.

Our YouTube channel fixes that.

We show you what most agents won't – what's really happening in Surrey & White Rock, and how to win whether the market's up or down.

It's free. No fluff. All signal.

Subscribe now — or stay guessing.

Darin Germyn

Categories

Categories

Recent articles

The Worst Condo Buildings in White Rock (And How to Avoid Them)

If you are looking at condos in White Rock or South Surrey, you have probably felt that little knot in your stomach. Prices look good, the photos look great, but something feels off. You are not…

How to Buy Luxury Real Estate in Surrey and White Rock, BC

Most people think luxury real estate is just a fancier version of a regular home. It is not. And that mistake can cost you a lot. I’ve helped hundreds of people buy and sell in White…

Best Private Schools in Surrey and White Rock

Most parents think choosing a private school is simple. They check rankings, read a few reviews, and assume they can just apply when the time feels right. It does not work like that. I help families…

Popular articles from our blog

Forget Kitsilano. Forget West Vancouver. A quiet transformation is taking place, and it’s happening in White Rock, BC. By 2030, White Rock is on track to become British Columbia’s most desirable postal code—not by chance, but…

If you’re looking to buy a home in South Surrey or White Rock, you’re probably feeling stuck. Detached homes are the Gold Standard–spacious, private, and entirely yours–but they come with a hefty price tag, often over…