Buying Smart: Understanding the Impact of Strata Fees on Surrey Condos and Townhomes

Introduction

In the world of real estate, condominiums have gained immense popularity among homebuyers. Whether it’s due to the improved freedom in lifestyle of living in a strata, or simply the affordability factor. Over 50% of people in the Lower Mainland now live in strata properties. We see so many would-be home buyers innocently get excited about all of the wrong features when buying into a strata complex without taking into account the entire picture.

Buying into a condominium or townhome is very much like buying into a business. There is a significant amount of expenses, ideally an adequate amount of income and a ton of variables to consider over whether the unit you found is excitingly pretty for your tastes. It is crucial to delve deeper into the dynamics of strata fees and their implications for your financial well being.

In this post, we will aim to provide you with valuable insights into the differences between high and low strata fee buildings, the pitfalls of poor management, and the significance of assessing the financial health of a strata property. By understanding these factors, you will be able to make an informed decision and better protect your investment when buying your next home in Surrey or anywhere in the Lower Mainland.

The Pitfalls of Poor Management in a Strata

Years back, we listed a condo for sale in the City of Surrey where the strata council (a collection of volunteer owners elected by owners to help manage the affairs of the building) made it their personal mandate to keep the strata fees as absolutely low as possible in this particular building. The owners, likely unknowing of the implications of their low strata fees LOVED it. The monthly carrying costs were substantial less than similar buildings in the area. New buyers loved the ideas of the The Pitfalls of Poor Management in a Strata as well, at least, at first sight. This, of course, was until they dove into the financials and details of the building, which read worse than a Stephen King horror novel.

To the naked eye, the hallways were a little banged up, the common areas needed a good cleaning and the wear and tear was evident yet managable to get a good deal in price for the average homebuyer. Here in lies the bigger problem. The building was in rough shape, both physically and financially.

Neglected for years to help maintain a low monthly fee for its residents, there was significant upcoming special levies (think a “cash call” for all owners) for repairs and updates. Ones that would cost the owners tens of thousands of dollars. To make matters worse, the residents had very little money in their contingency reserve fund, meaning they would have to pony up the funds for the required upgrades.

Once buyers learned how terrible this building was, they would run for the hills. It became almost IMPOSSIBLE to sell.

Unveiling the Myth of the Benefit of Low Strata Fees

My cautionary tale above highlights the importance of proper management in strata properties. Low strata fees, while attractive in theory, can lead to under-funding and neglect of essential maintenance. After getting into the details on a purchase such as this, it becomes evident that low strata fees do not always equate to a good investment for a home buyer. This emphasizes the need for well-managed buildings, regardless of the fee structure.

How a Strata Can Properly Budget For Today, and Tomorrow.

Strata fees play a pivotal role in maintaining the overall well-being of a complex. These fees cover various expenses including insurance, management, landscaping, and maintenance while also contributing to the contingency fund for unforeseen emergencies or maintenance/upgrades that don’t occur frequently. By appropriately budgeting through strata fees, buildings can ensure ongoing maintenance and avoid hefty special levies that may diminish resale value.

When we look at how strata’s fund any building maintenance items, there are really only 3 ways to finance the operations and needs of a complex or building.

- Pay now– high fees to build up a large contingency resulting in no cash calls for emergency repairs or significant upgrades

- Pay later– low fees avoiding reasonable contribution to both the operating fund and contingency fund, resulting cash calls for almost everything, and a very badly neglected building

- A hybrid model– providing savings to fund the majority of the buildings needs while still maintaining a reasonable monthly strata fee, and the potential of smaller cash calls for major projects or emergencies as needed

Are under-funded Stratas only a problem in Surrey?

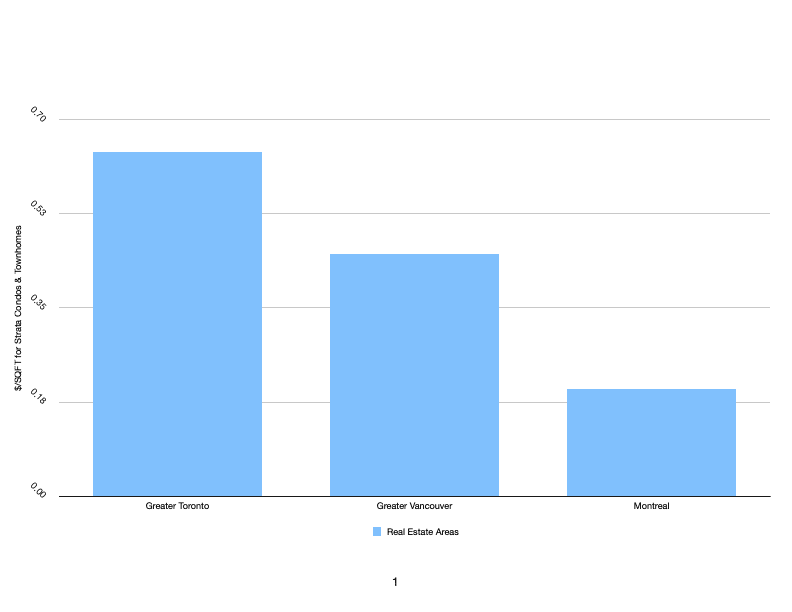

It would be wise to tell you now that it is estimated that over 90% of strata buildings in BC are underfunded. SquareOne.ca states that monthly condo fees in the GTA (Greater Toronto Area) average at about 65 cents per square foot, whereas in Greater Vancouver, our monthly condo fees average about 45 cents per square foot.

This means that on average, people in Toronto are paying approximately $160 more per month for their strata fees than people in Greater Vancouver. Residents of Surrey and the rest of the Lower Mainland are simply paying too little in strata fees. This alarming statistic underscores the need for a comprehensive understanding of strata fees and their impact on long-term financial stability. Buyers must look beyond the fee amount and consider the overall financial health of the strata property.

Here’s what the BC Government is doing to address underfunded strata complexes

Starting in November of 2023, the BC government is mandating strata properties raise the minimum contribution to the contingency fund in all strata complexes from 5% of their annual operating budget to 10%.

This isn’t limited to just existing condos or townhomes either. New construction complexes will not be immune from this new legislation, which is great news because new construction has been notoriously underfunded in its primary years. Now developers will also have to start off a new construction complex with at least 10 % of the annual operating fund waiting in the contingency fund.

(Sorry for those that want to buy brand new homes, this really just translates into more expensive homes)

How to Compare Different Strata Buildings

When comparing two similar buildings, a higher contingency reserve fund or strata fees may signify a better investment, but not always. A savvy home buyer will know that details matter, and in this case there is lots to the story. You must take into account the upcoming maintenance or repair in the complex, as well as what has occurred in the past, the strength of the contingency fund, age of the existing infrastructure and more.

Evaluating the funding status of a building when comparing the variables mentioned above, is absolutely crucial in making informed, investment decisions. Some of the documents that can assist a home buyer in their research include

- a recent depreciation report (a 30 year planning tool and infrastructure summary)

- 2 years worth of Council meeting minutes (a detailed summary of the meeting)

- a full set of financials

- a reserve fund study

What Influences Strata fees?

Several factors influence strata fees and a prospective buyers must consider them all carefully. The age of a building often correlates with higher fees due to increased maintenance costs however the history of maintenance, upkeep and infrastructure replacement makes all complexes unique.

Additionally, larger complexes tend to have lower fees as expenses are divided among a greater number of owners. Amenities, such as pools and fitness centres also impact fees as their operations and maintenance incur additional costs. Understanding these factors helps you assess the value and sustainability of a home you are considering.

There is also the Unit entitlement of each unit. For the simplicity of this article, generally the unit entitlement of a unit corresponds with the amount of the strata development the strata lot occupies. This is the most common method of calculating unit entitlement, but not always so be sure to ask your REALTOR® to explain this in further detail when considering a specific unit to purchase.

How to buy a strata home in Surrey and eliminate the risks

When buying in a strata property, underfunded buildings are a serious trap potential homebuyer can easily fall prey to, thus thorough due diligence is essential. Seeking input from third parties, such as strata managers or council members, can provide valuable insights into a property’s financial situation. Reviewing the depreciation report, historical fee increases, and scrutinizing strata minutes can help gauge the financial management and transparency of the complex. Armed with this knowledge, you can make informed decisions and ensure you have been as diligent as possible.

For more on the general requirements to find a home in Surrey, check out our blog here.

Conclusion

Understanding the nuances of strata fees is crucial for anyone seeking to purchase a condominium or townhome. Whether it be in Surrey or elsewhere in the Lower Mainland. By recognizing the potential pitfalls of underfunded buildings, prioritizing proper budgeting, and conducting a thorough assessment of a strata property’s financial health and management practices, a home buyer can safeguard their financial interests.

And let’s be clear, this is not something you should do on your own.

Seeking professional assistance from realtors like the Germyn Group can provide valuable guidance in navigating the complexities of strata property evaluation. Remember, it is not merely about finding the lowest strata fees but ensuring that your investment aligns with a well-managed and financially stable strata complex.

To take advantage of an obligation-free home buyer’s strategy call, visit the link below to book a time to speak with our team.

People lose money in real estate because they don't know what's actually happening.

Our YouTube channel fixes that.

We show you what most agents won't – what's really happening in Surrey & White Rock, and how to win whether the market's up or down.

It's free. No fluff. All signal.

Subscribe now — or stay guessing.